- This topic is empty.

-

AuthorPosts

-

2026-01-19 at 9:25 am #65452

Understanding Tungsten Carbide Ball Specifications

Before initiating supplier outreach, establish your technical baseline requirements.

Critical Material Properties

Hardness Performance:

-

Standard tungsten carbide achieves HRA 88-92 (Rockwell A scale)

-

Cobalt binder content typically ranges 6-12%

-

Superior wear resistance: 30-50x longer lifespan than chrome steel in abrasive slurry applications (based on comparative wear testing in ball mill operations at 75% critical speed, 40% slurry concentration)

Composition Standards:

-

Primary carbide phase: WC (Tungsten Carbide) 88-94%

-

Binder material: Cobalt (Co) or Nickel (Ni) alloys

-

Grain size: 0.5-1.5 μm for precision applications

-

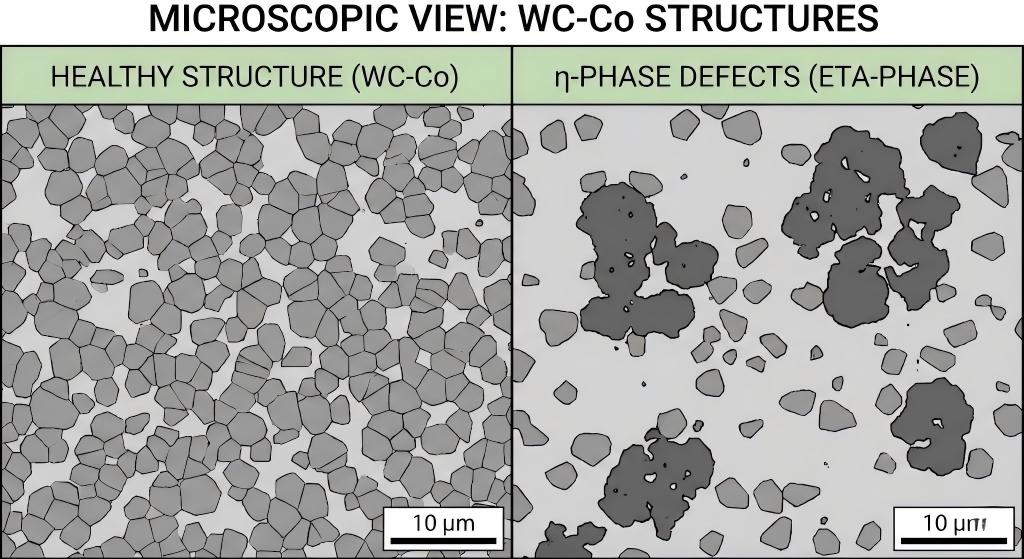

η-phase control: Critical defect phase (Co3W3C) must be <2% by volume to prevent brittle failure

Density & Porosity Verification:

-

Target density: 14.5-15.0 g/cm³

-

Deviation tolerance: ±0.2 g/cm³ maximum

-

Porosity classification: Type A (≤0.02 mm pores), Type B (≤0.1 mm), per ISO 4505 inspection standards

-

Low-density or high-porosity units indicate improper sintering or contamination

Mechanical Integrity:

-

TRS (Transverse Rupture Strength): Minimum 2,400 MPa for bearing applications

-

Fracture toughness (KIC): Target 10-14 MPa·m^1/2 (higher cobalt content improves toughness but reduces hardness)

-

Magnetic saturation: Typically 15-30 emu/g depending on cobalt content (critical for non-magnetic application screening)

Precision Grade Classification

Tungsten carbide balls commonly adopt steel ball precision grading conventions (derived from ISO 3290-1 for steel balls, adapted as industry practice for carbide spheres). Note that no universal ISO standard specifically governs tungsten carbide ball tolerances; manufacturers typically reference:

-

Customer technical drawings

-

ANSI/AFBMA standards (for bearing applications)

-

Internal enterprise specifications validated through customer acceptance

Grade Spherical Deviation Surface Roughness Application Example G5 ≤0.13 μm Ra 0.010 μm Ultra-precision bearings, metrology G10 ≤0.25 μm Ra 0.014 μm High-speed spindle bearings G25 ≤0.65 μm Ra 0.025 μm Check valves, ball screws G100 ≤2.5 μm Ra 0.100 μm Grinding media, impact tools Always request supplier's inspection methodology and acceptance criteria documentation when specifying precision grades.

Real-World Application: Case Study

How We Reduced Valve Failure Rates by 43% Through Precision Upgrading

Client Challenge:

A European hydraulic valve manufacturer experienced 12% field failure rates within 18 months due to ball seat wear in high-pressure (350 bar) pneumatic control valves. Their existing G100-grade carbide balls from a low-cost supplier exhibited:-

Inconsistent sphericity (actual deviation 3.2-4.1 μm vs. specified 2.5 μm)

-

Surface microcracking visible under 500x magnification

-

Density variation 14.2-14.7 g/cm³ (indicating incomplete sintering)

Our Solution:

After sample evaluation in our laboratory, we identified η-phase contamination (4.2% by volume) and Type C porosity (0.15 mm pore clusters) as root causes. We proposed:-

Upgrade to G25 precision grade with guaranteed ±0.3 μm sphericity tolerance

-

Extended sintering cycle: 1450°C for 90 minutes (vs. competitor's 60 minutes) to achieve 99.8% theoretical density

-

Post-sinter HIP treatment (Hot Isostatic Pressing) to eliminate residual porosity

-

100% automated optical inspection to screen surface defects >5 μm

Measurable Results (12-month field tracking):

-

Failure rate reduced to 6.8% (43% improvement)

-

Average operational lifespan extended from 14 months to 28 months

-

Customer's warranty claim costs decreased by €127,000 annually

-

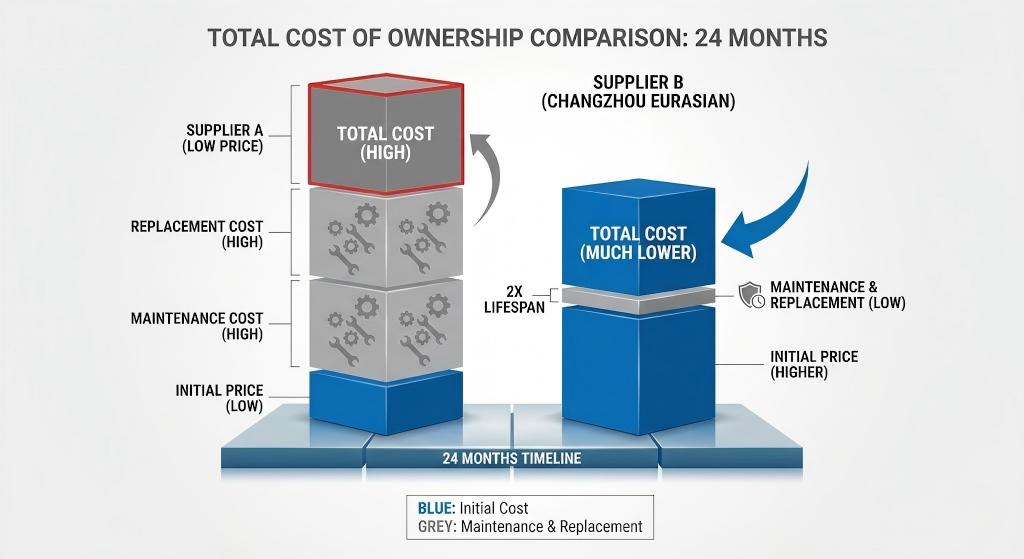

Unit cost increase of 18% offset by 2.6x total cost of ownership savings

This case demonstrates why precision grade selection must align with application severity—not just initial purchase price.

5-Point Supplier Qualification Framework

1. Manufacturing Capability Assessment

Essential Production Technologies:

-

Cold isostatic pressing (CIP): Ensures uniform density distribution (target pressure: 200-300 MPa)

-

Vacuum sintering furnaces: Prevents oxidation during 1350-1500°C sintering cycles (atmosphere control: <5 ppm O2)

-

Centerless grinding equipment: Achieves sub-micron sphericity tolerances

-

HIP facilities (optional): For eliminating residual porosity in ultra-critical applications

Red Flags to Avoid:

-

Suppliers unwilling to disclose sintering temperature profiles or furnace atmosphere control data

-

Absence of in-house grinding capabilities (outsourced finishing reduces quality control)

-

Limited size range (indicates tooling constraints)

-

No mention of grain size control or powder supplier certification

Our Manufacturing Standards:At Changzhou Eurasian Steel Ball Co., Ltd., our IATF 16949:2016 certified facility operates dedicated CQI-9 standard heat treatment lines. Our precision grinding workshops utilize German-engineered centerless grinders capable of holding ±0.5 μm tolerances across production batches. All sintering cycles are logged with real-time temperature/atmosphere monitoring per automotive industry requirements.

2. Quality Control Infrastructure

Mandatory Testing Equipment:

-

Roundness measuring instruments: Must verify sphericity to 0.08 μm resolution (e.g., Talyrond systems)

-

Rockwell hardness testers (HRA scale): For carbide material hardness verification (ASTM E18 calibration required)

-

Optical or ICP spectrometers: Confirm tungsten and cobalt composition percentages (accuracy: ±0.1% for major elements)

-

Surface profilometers: Measure Ra (surface roughness) to 0.005 μm accuracy

-

Metallographic microscope: For η-phase detection and porosity classification (minimum 500x magnification)

-

Magnetic saturation tester: Verify cobalt content consistency (especially for applications requiring <50 emu/g limits)

Request These QC Records:

-

Statistical Process Control (SPC) charts showing Cpk values ≥1.33 for sphericity and diameter

-

Material certificates tracing tungsten powder origin (WC powder grade: typically WC-1 to WC-3 per supplier specifications)

-

Dimensional inspection reports with minimum 50-piece sample sizes per production lot

-

Porosity inspection reports with pore type classification per ISO 4505

-

TRS test data from 3-point bend testing (minimum 5 samples per batch for critical applications)

Our Quality Lab:Our ISO-accredited laboratory houses advanced metrology equipment including:

-

Talyrond roundness tester (0.01 μm resolution)

-

Rockwell hardness tester calibrated to ASTM E18 standards

-

Optical emission spectrometer for WC/Co ratio verification

-

Vibration measurement system for dynamic performance testing

-

Metallographic preparation station with image analysis software for microstructure evaluation

3. Certification & Compliance Validation

Material & Process Standards:

-

ISO 4499-2: Hardmetals (cemented carbides) – Metallographic determination of microstructure (porosity & η-phase)

-

ISO 3878: Hardmetals – Vickers hardness test

-

ISO 4505: Classification of porosity types in cemented carbides

-

RoHS/REACH: Environmental compliance for European markets

Application-Specific Certifications:

-

IATF 16949: Automotive industry quality management (critical for powertrain applications)

-

AS9100: Aerospace quality standards

-

FDA compliance: For food processing or pharmaceutical equipment (requires additional surface cleanliness validation)

Third-Party Verification:Always request Bureau Veritas (BV) or equivalent audit reports. Factory audits should cover:

-

Raw material traceability systems (tungsten powder sourcing records)

-

Calibration records for measurement equipment (annual external calibration mandatory)

-

Non-conforming product control procedures

-

Sintering furnace temperature uniformity surveys (±10°C across work zone maximum deviation)

Changzhou Eurasian Steel Ball holds IATF 16949:2016 and Bureau Veritas factory certifications, ensuring automotive-grade quality systems with full powder-to-finished-ball traceability.

4. Tungsten Carbide Ball Price Analysis

Cost Structure Breakdown:

Tungsten carbide ball price varies significantly based on:

-

Raw material costs (as of Q4 2025 data):

-

APT (Ammonium Paratungstate): $415-480/MTU (Asian markets), $825-900/MTU (European spot markets) – Source: Metal Bulletin, London Metal Exchange reports

-

Cobalt metal powder: $32,000-46,000/metric ton (fluctuates with DRC mining supply) – Source: Fastmarkets cobalt index

-

WC powder conversion: Add $15-25/kg processing cost from APT to carbide-grade powder

Size premium: Balls >25mm diameter incur 15-30% surcharges due to extended sintering cycles (cycle time increases exponentially with mass)

Precision grade multiplier:

-

G100 baseline

-

G25: +40-60% (additional grinding time)

-

G10: +120-180% (ultra-precision grinding + 100% optical inspection)

Cobalt content impact: Each 1% increase in Co content adds approximately $0.80-1.20/kg to material cost

Pricing Red Flags:

-

Quotes 30-40% below market average often indicate:

-

Recycled or secondary-grade tungsten powder (detectable via trace element analysis)

-

Inadequate sintering time (compromises density and η-phase control)

-

Outsourced production with inconsistent quality

-

Hidden costs (inspection, packaging, freight not included in base price)

Value-Based Comparison:Request pricing based on:

-

$/mm³ of material for diameter-normalized comparison

-

Cost per 10,000 operational hours in your specific application (requires supplier to provide wear rate data)

-

Total cost of ownership (TCO) calculator: Factor replacement frequency, downtime costs, inspection labor

Example TCO Analysis:

Supplier A: $12/ball, 14-month lifespan → $10.29/year

Supplier B: $18/ball (+50% unit cost), 28-month lifespan → $7.71/year (-25% TCO)Pricing Transparency Checklist:Always clarify what's included in quotes:

-

[ ] Material grade (WC powder classification, Co %)

-

[ ] Precision grade with actual tolerance values

-

[ ] Inspection scope (100% dimension check? Sample-based hardness?)

-

[ ] Packaging type (anti-rust treatment, VCI bags?)

-

[ ] Incoterms (FOB, CIF, DDP?)

-

[ ] Payment terms and currency

-

[ ] Minimum order quantity (MOQ) per specification

5. Supply Chain Reliability Metrics

Lead Time Benchmarks:

-

Standard sizes (1-20mm, G25-G100): 3-4 weeks after order confirmation

-

Custom specifications: 6-8 weeks including first article inspection (FAI)

-

Emergency orders: Reliable suppliers maintain safety stock for common sizes (typically 500-2000 pcs per SKU)

-

Re-orders for approved specifications: 2-3 weeks (eliminates FAI cycle)

Capacity Indicators:

-

Monthly production capacity: Reputable manufacturers produce 50+ tons/month (calculated as finished carbide ball output, excluding grinding scrap)

-

Multi-shift operations ensure consistent quality (avoid single-shift facilities with fluctuating QC)

-

Raw material inventory: 60-90 days buffer indicates financial stability

-

Sintering furnace quantity: Minimum 3-5 vacuum furnaces to handle batch segregation and prevent cross-contamination

Geographic Considerations:

-

Chinese manufacturers: Cost advantage of 25-35% vs. Western suppliers; dominant global market share (production ~83% of global supply as of 2024, though reserves represent ~52% of known deposits – Source: USGS Mineral Commodity Summaries)

-

European/US suppliers: Premium pricing but shorter lead times for domestic buyers (5-10 days typical)

-

Freight costs for tungsten carbide spheres:

-

Sea freight: $0.08-0.15/ball (bulk orders >1000 kg, 25-35 days)

-

Air freight: $0.35-0.60/ball (urgent orders, 5-7 days)

-

Packaging weight factor: 1.8-2.2x ball weight due to anti-corrosion materials and cushioning

Supply Chain Risk Mitigation:Given tungsten's supply concentration (China accounts for ~83% of production despite holding ~52% of global reserves – 2024 USGS data), consider:

-

Dual-sourcing strategy: Primary Asian supplier + secondary Western backup

-

Long-term pricing agreements: 12-24 month contracts with quarterly escalation clauses tied to APT index

-

Inventory buffering: Maintain 90-120 days on-site stock for mission-critical applications

-

Material substitution planning: Identify alternative grades (e.g., steel, ceramic) for lower-severity applications to reduce tungsten dependency

http://www.cnballs.cn

Eurasian -

-

AuthorPosts

- You must be logged in to reply to this topic.